In today’s world, scam artists have become increasingly sophisticated in targeting individuals. However, older adults may be more vulnerable to these frauds. These deceptive practices, known as senior scams, exploit the vulnerability and generosity of older adults, resulting in significant emotional and financial harm.

At The Monarch Senior Living, we want you to be aware of some of the most common scams out there, so we’re providing information to help you recognize them and protect yourself against them.

Understanding Senior Scams

Senior scams can occur in many forms, from phone calls and emails to door-to-door solicitations. Older adults are often targeted because they may be less familiar with modern technology, more trusting, or more isolated. The impact of these scams can be devastating, leading to financial loss, emotional distress, and strained family relationships. It’s crucial for both older adults and their families to understand these threats and take proactive steps to combat them.

Top 7 Senior Scams

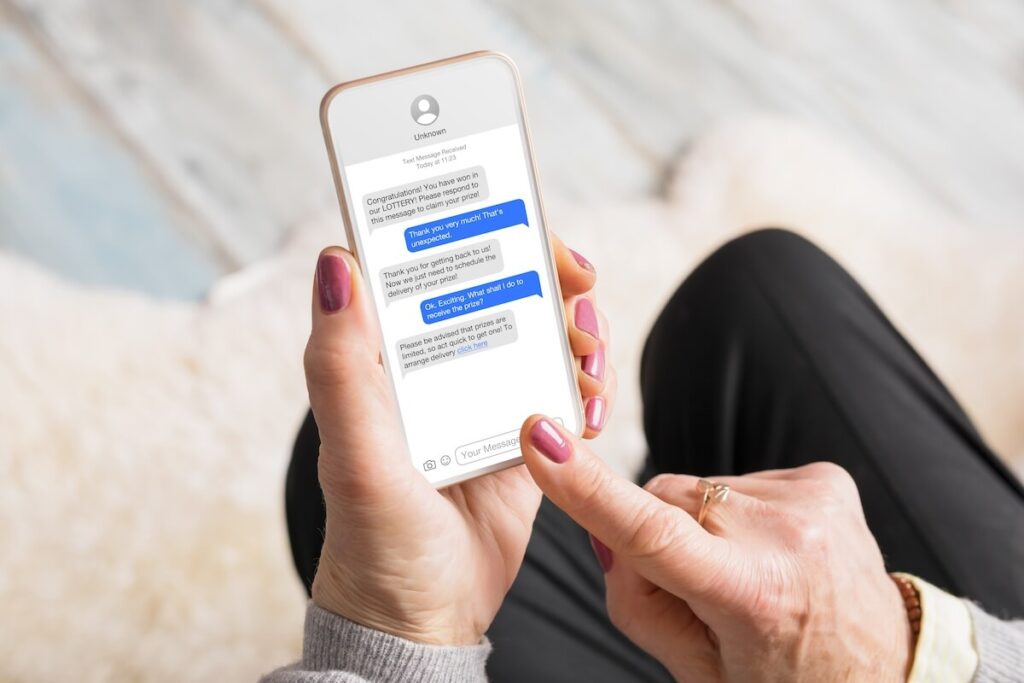

Lottery Scams

Lottery scams involve scammers informing older adults that they’ve won a large prize but must first pay taxes or fees to claim it. These scams can be highly convincing, often including official-looking documents and promises of a substantial payout. The reality is that once the fees are paid, the scammers disappear, leaving the older adult with nothing but financial loss.

Call Scams Pretending to be a Relative

In call scams, scammers pretend to be a relative, often a grandchild, in urgent need of money. They might claim they’ve been in an accident or arrested and need bail money. The scammer’s sense of urgency and emotional manipulation can prompt older adults to act swiftly without verifying the caller’s identity, resulting in significant financial loss.

Investment Schemes

These fraudulent practices lure older adults with promises of high returns on investments that are either non-existent or highly risky. These scams prey on the desire for financial security and can lead to the complete loss of retirement savings. Older adults should be wary of unsolicited investment offers and always consult a trusted financial advisor before making any decisions.

Internet Fraud

Internet fraud involves a variety of online scams, including phishing emails, fake websites, and fraudulent online shopping. Older adults may be targeted with emails that appear to be from legitimate sources, asking them to provide personal information or click on malicious links. These scams can result in identity theft and financial loss.

Telemarketing Scams

These practices involve unsolicited phone calls from scammers posing as legitimate businesses or charities. They may offer deals on products or services or request donations for fake causes. These calls can be persistent and persuasive, pressuring older adults to provide credit card information or send money.

Identity Theft

Identity theft occurs when scammers obtain personal information, such as Social Security numbers or bank account details, and use it to commit fraud. Older adults are particularly vulnerable to this type of scam, which can lead to unauthorized charges, loans, and a damaged credit score. It’s essential to protect personal information and monitor financial accounts regularly.

Credit Card Fraud

Credit card fraud involves the unauthorized use of an older adult’s credit card information to make purchases or withdraw cash. This can happen through stolen cards, phishing scams, or data breaches. Individuals should report lost or stolen cards immediately and review their statements for any suspicious activity.

Recognizing and Preventing Senior Scams

To effectively prevent senior scams, we must first recognize their signs. Being cautious of unsolicited communications and offers that seem too good to be true can help individuals stay protected. Scammers often exploit emotions, particularly targeting older adults who may be more vulnerable. They use tactics like creating a sense of urgency, posing as trusted figures, and employing manipulation. It’s crucial for older adults to maintain a healthy skepticism, verify claims independently, and think twice before acting on emotional appeals.

Remember, awareness and education about these tactics are key. Utilizing technology, such as caller ID and spam filters, can help block unwanted communications. If a scam occurs, it’s important to report it immediately to the appropriate authorities and seek help to minimize the impact.

—

By staying informed and vigilant, you can protect yourself from senior scams. Senior living communities play a vital role in this effort by fostering a setting of security and education. To learn more about our senior living communities and the services we provide, contact a member of The Monarch Senior Living team today!